The resilience of our medical systems are under a huge amount of pressure amidst this Coronavirus pandemic, but we are also suffering an unprecedented near complete and global shutdown of the economy. The length and duration of the lockdowns and the uncertainty around how often these may occur again in the future, makes it difficult to second guess what might happen to any business. This means that we are also seeing businesses having to change their way of working overnight. What is going to happen to large office buildings? Where are all the shops going to go? What will consumer demand look like after this is over? Who will be left and in a strong enough financial position to recover quickly?

When we emerge the other side of this medical and economic crisis, businesses will be saddled with debt and with low, if any, cash reserves. This has the direct effect of making sound businesses of all sizes become higher credit risks overnight, which we believe will last for some time during the recovery. The banks’ willingness or unwillingness to lend, even with heavy state guarantees, is a good indicator of how all businesses should view counterparty risk – as high. In the UK, the promised relief of £330bn for the CBILS scheme is proving slow to be distributed and with loan approval rates at the time of writing is at around a very low 2%. They are just not comfortable with the exposure. How is all of this going to impact lending and credit markets in the longer term?

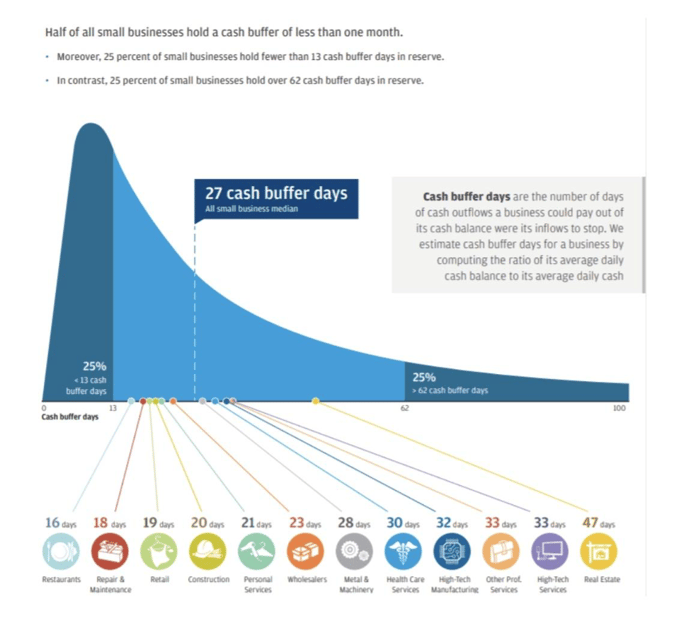

Businesses you may have developed strong and trusted relationships with may become bad debtors, not because of mismanagement of the business, but due to this prolonged shutdown and with no revenues coming in. Most Small Medium Enterprises (SMEs) have on average 27 days of cash buffer days. Many are experiencing little or no revenue. This makes doing business on any form of credit terms very challenging.

Escrow to mitigate your supply chain risk

Business must go on. The only road to recovery is for business to resume as quickly as possible. But until these uncertainties are over, how can risk and exposure be managed in your supply chain? The risks here sadly lie with both the seller and buyer of the goods or services. Either party may become insolvent, which makes the use of a deposit or partial payment paid to the seller high risk and for a seller to offer 30, 60 or 90 day payment terms less appealing today than during normal market conditions. Will these options still be available?

The use of escrow facilities seems to be a natural place where these insolvency risks are mitigated. Additionally, where existing supply chains have been disrupted, companies are forced to transact with unknown, and therefore untrusted parties – another scenario where an escrow solution is invaluable.

During this current crisis Shieldpay has experienced a sharp rise in inbound requests for escrow services from the manufacturing and supply chain sectors, including for the supply of some essential PPE.

Some of the other benefits we can see from escrow as a solution:

- It really does mean ‘show me the money’ and commitment to buy

- Funds are insolvency protected and held for the benefit of both parties, equally

- It is possible to have staged release of payments for tranches of work completed

- Funds will only be released when parties to the transaction agree or there has been a legally binding decision in respect of any dispute

- There is comfort in knowing that the counterparty in the transaction will have been required to undertake the same level of due diligence as you, including verification of the recipients’ bank account, in turn mitigating the risk of falling victim to fraud or human error

- Helps streamline any joint venture payments

Traditionally, setting up an escrow has been cumbersome, time consuming and costly to set up. It has therefore tended to remain the domain of law firms and those involved in the real estate, be it as part of the transaction or in construction.

Why Shieldpay vs. traditional bank-based escrow:

- Very quick set up times – 48 hours to set up a Shieldpay escrow vs. up to 6 weeks to set up an escrow with a bank

- It’s a simple process that can be completed with or without the help of lawyers

- The Shieldpay platform allows full transparency to all parties at any time around status of funds – user access and permissions can be fully customised as required

- Competitive, one-off transaction set up fee with no ongoing maintenance charges

- Upload key deal documents to the platform, e.g. invoices, proof of delivery, underlying SPA etc

- White glove service to provide end-end assistance

Today’s ongoing crisis is propelling Corporates to look outside the box for more options to better manage risk and control liquidity. However, often the challenge with adoption of new or non-traditional strategies such as escrow facilities lies in the complexity to execute and manage them effectively without introducing more risk.

To help make these options viable solutions for corporates risk and liquidity management, we are looking to partner with treasury management software providers such as TreasuryXpress.

Working with these types of solutions would allow clients to create one central universe to operate in to create comprehensive visibility and controlled management; thereby eliminating the barriers traditionally associated with introducing new strategies and utilising TreasuryXpress.

---------------

Article written by Geoff Dunnett, and contributed to by TreasuryXpress.

Geoff Dunnett is Professional Services Director at Shieldpay and can be contacted on 07900214500 or gdunnett@shieldpay.com.

COMMENTS