Whether just starting out or already establishing a loyal customer base, by seeking outside investment a company can grow much faster, building currency and generate profit. Every business is unique, so it is hardly surprising that every funding round is different. The size of the round, the investors, the timeline, and the current investment landscape all impact how the round will be completed.

There are common themes however, that can be identified in relation to what stage a company is at through its lifecycle. Regardless of the factors above, the company’s ability to progress through each stage will become the catalyst for their ability to raise capital.

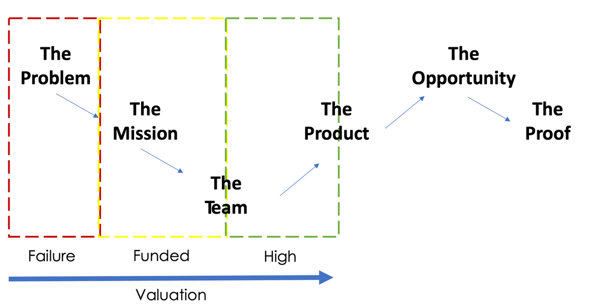

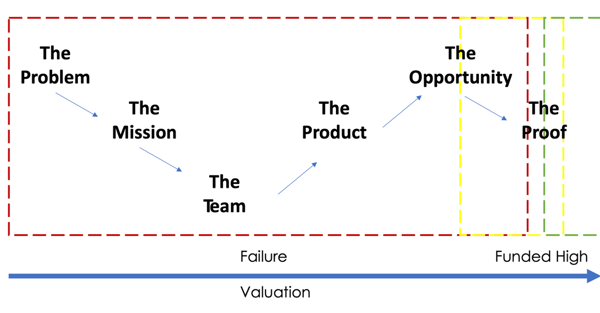

There are the six stages of a company’s lifecycle. The company evolves as certain milestones are hit and as the market evolves around it. The valuation and the likelihood of investment changes dramatically as the company moves through each stage.

So what are the six phases a company will move through?

1. The Problem – How big is the problem you want your business to solve? How many individuals or businesses currently have to deal with this specific problem and how much are they willing to spend on fixing this problem themselves? What is the potential for outsourcing a solution for this problem?

2. The Mission – A clear true north that is driving the team. The company’s team, product and investors will change considerably over time; if the company maintains a strong mission statement and driving set of principals then these changes are unlikely to derail the company’s focus.

3. The Team – Is this team capable enough to solve the problem and drive the business? This will be an analysis of previous experience, industry background and the robustness of the relationships of the founders.

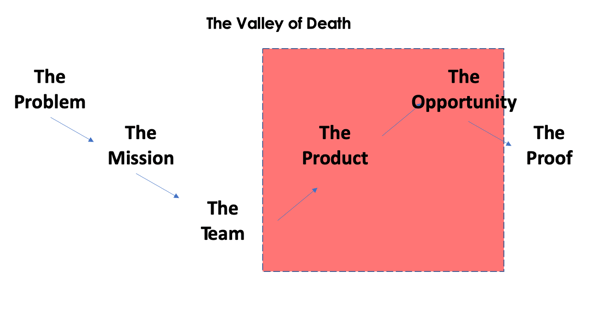

4. The Product – Can the product solve the problem and will people pay to use it? You could have the best team in the world, with incredible funding but if there is no real need for the product or it doesn’t solve enough of the problem, then it’s likely to fail. This phase is also known as the valley of death (more on this later).

5. The Opportunity – Once product market fit is achieved, the opportunity phase is all about timing. Will the company and its product scale based on the maturity of the market and the take-up rate of the new service becoming mainstream? Has more competition emerged?

6. The Proof – This phase is all about the numbers and how much traction has the company managed to achieve. These are the defining metrics used to value companies beyond the Series A stage. By now if you haven’t proved out the team, the product and the size of the growth opportunity, then you are very unlikely to get funded.

It is highly unlikely that the company will be able to progress through all these phases with one funding round. That is why funding rounds are often broken up into stages or series.

These three stages are typically known as:

- Concept Stage, (angel-seed rounds)

- Foundation Stage (seed – Series A)

- Growth Stage (Series A and beyond)

Explaining the stages

Angel to Seed – Concept Stage

The first stage of funding for most companies is their Angel round. At this stage the company will have very limited resources and little to no proof points. Angel investors are focused on the problem that the company is trying to solve and require a level of confidence that the right founding team is in place to solve that problem.

Mission impossible?

It’s unlikely that the company will get funded if investors are not excited by the company’s mission, or believe that the problem is large enough. Early stage investors know that the product they see today is highly unlikely to be the end product so need to have confidence that the management team are resilient enough to find the right product solution.

A high Angel round valuation will be achieved if the company is able to showcase they have built a working prototype of the product that solves the problem at a limited capacity, and has the beginnings of a strong management team to scale the business.

Type of investor – Individual angel investors, friends and family, accelerators and incubators.

Seed to Series A – The Foundation Stage

At the Seed round stage, the company will have had to progressed significantly from the concept stage. By this time you have a live product with demonstrable results. The company will still have limited resources, but will have the early stages of product market fit and a small client base.

The foundations of the commercial model will be in place but at this stage it’s likely to be inefficient and won't deliver the margins required for later stage companies. However, although the unit economics may not be optimised, there is a growing sales pipeline and the ability to showcase a growing market demand for the service.

From pipe dream to pipeline

The company is unlikely to progress beyond this stage if they have no commercial metrics or the ability to showcase a sales pipeline and expected revenue growth. Investors won't generally be looking for profitable companies at this stage (because why would you need investors), but this will change depending on the type of industry you are in.

High valuations are achieved with greater proof points and a demonstrable business plan that will enable the company to achieve a strong market presence in the industry.

At this stage investors will also be looking for client references and will often want to see a ‘use of funds’ document which highlights what the investment funds will be spent on and why. Investors will struggle to fund companies at high valuations if they are still trying to pivot the company into the right business model.

Type of investor – High net worth angel investors, early stage venture capital firms, smaller family offices.

Series A and Beyond – Growth Stage

At this stage of funding, it’s all about the numbers. Growth stage investors focus and spend a lot more time on evaluating the commercial model than early stage investors. Investors will expect the company to have strong product market fit and the ability to demonstrate growth over a 12 to 24-month period.

This is the most challenging funding round as it means that every company that receives funding beyond Series A has managed to get past the number one cause of start-up failure –no product market fit or market need.

Beware of the valley of death

Regardless of the quality of the founding team, the size of the problem or the quality of the product, no company will achieve Growth stage financing without being able to demonstrate that their product solves the problem at scale and that the commercial model will bring significant returns for these investors.

This start-up phase is also known as the ‘Valley of death’, due to the very high % of companies that fail to progress to the proof phase.

This start-up phase is also known as the ‘valley of death’, due to the very high % of companies that fail to progress to the proof phase.

Avoiding this ‘valley of death’ is hugely challenging as there is little funding from earlier rounds and therefore not a large window of time for the company to make the necessary product and commercial adjustments to get the levels of traction required to convince investors of the opportunity. The only way to find product market fit is through experiments. And, most will fail.

It is hugely important to have patient, understanding investors as the ability to extend out this window of time to get product market fit is so often the deciding factor in a company's success or not. At this stage a large percentage of companies will engage in ‘bridge’ funding events to elongate this window of time and get the company through the valley of death.

There are variations of ‘bridge’ rounds and these can be in the form of convertible loan notes or advanced subscription agreements. These options provide the investor with a discount to the main round and provide the company access to funds without having to set valuations. These notes have become increasingly popular as can benefits both the investor and the company during this difficult phase in the company lifecycle.

Type of investor – Venture capital firms, larger family offices, early stage private equity firms.

Company lifecycle: a marathon not a race

Of course, each company’s funding journey will differ and progress at different rates depending on the market and type of products. However, there are common themes that will shape a company’s ability to raise finance: demonstrating product market fit. Once that is done, it is all about execution. Those companies that succeed are those that manage to cross this chasm as efficiently as possible with backers who believe they can get there.

Raising a round?

Discover how Shieldpay’s digital escrow solution for fundraising can help. Enquire today for a quote.

COMMENTS