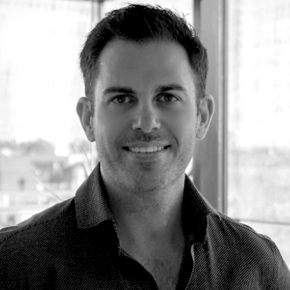

Pete Janes shared his insights for a recent edition of The Fintech Times' Behind the Idea series.

----------------------------------------------------------------------

Complex financial transactions are an integral part of the legal and professional services industries. However, these transactions often present significant challenges, from security and transparency to efficiency and speed.

Shieldpay, led by CEO and founder Pete Janes, is a payment processor designed to address the unique challenges of complex transactions within the legal and professional services sectors.

In this week’s Behind the Idea, Janes shares insights into Shieldpay’s mission to relieve law firms of the administrative and financial risk burden associated with handling payments on behalf of their clients.

Tell us more about your company and its offering

Shieldpay is a payment processor that solves complex transactions for the legal and professional services industries. We prioritise user-centricity with capabilities such as open banking and automation to send and receive high-value, time-sensitive payments securely.

Our cloud-based payments platform is made up of three core capabilities, verify, hold and disburse. Through these functions, we offer our clients a faster and more secure way to send and receive high value payments.

To put it simply, we focus on transactions that require a third party to validate and safeguard funds – this includes M&A, class action lawsuits, real estate, and supply chain transactions. Our ultimate ambition is to be a trusted partner for moving substantial sums of money worldwide, as we shape the future of payments.

What problem was your company set up to solve?

Since the company was established in 2016, Shieldpay continues to address a pivotal need – supporting businesses and securely managing their payments.

By prioritising simplicity – through our cloud-based platform – we’re shedding complexity and inflexibility. Automation plays a pivotal role in eliminating manual interventions and streamlines processes for professional and legal services.

Since launch, how has your company evolved?

Since inception, we’ve continually innovated and improved our services, paving the way for us to become the go-to payment partner for complex, high value global transfers. We recently partnered with Landmark, to modernise financial settlements in conveyancing and The International Stock Exchange (TISE), to transform private market trading with automated payments, broadening our horizons beyond our typical use cases.

From utilising videos for lifeness checks to leveraging open banking for bank account verification – our software gives clients peace of mind that the most complex transactions are settled securely and efficiently.

As the business continues to grow and expand, we remain committed to empowering businesses worldwide to complete their deals with certainty – ensuring that our product roadmap is guided by our core principles – simplicity and automation.

What has been the biggest challenge or most ‘tricky moment’ to overcome?

In the legal sector, there is a huge chasm to cross for any new start-up entering the space and that is reputation. The average transaction that Shieldpay processes for our clients is much larger than the everyday payments that the majority of fintechs will process.

The legal sector is notoriously risk-averse and this, coupled with the very large transaction size means that there was (and continues to be) a huge amount of work that the team had to do to obtain a reputation in the market to be trusted by this client base.

What are your biggest achievements or ‘proudest moments’ so far?

As a founder, my journey has been marked by remarkable milestones. From pioneering the world’s first fully digital mortgage settlement in 2018, to processing our first £1 billion in payments which took three years of dedication then the next £1 billion in just six months – each achievement has been fueled by our ambition.

But perhaps one of the proudest moments was being selected for the prestigious Mastercard Startpath program, an honour shared with industry giants like Revolut. This recognition is testament to my incredible team and the vision driving our success.

How would you describe the culture of your company?

At Shieldpay, our foremost priority is the satisfaction and well-being of our team, as we understand the positive impact employee well-being has on workplace culture. Cultivating a thriving, inclusive workplace is invaluable to us.

Our organisational culture places a strong emphasis on respect and professionalism, nurturing an environment that empowers individuals to excel and feel supported. We take great pride in our recent recognition by Flexa, acknowledging our commitment to fostering a truly adaptable work atmosphere, as we firmly believe that our team’s success is amplified through flexible working arrangements.

Diversity is a cornerstone of our values, as evidenced by our achievement of nearly 50% gender balance within our company – a remarkable accomplishment, particularly within the tech industry. This milestone underscores our dedication to cultivating an inclusive and diverse workforce where individuals from varied backgrounds and perspectives are encouraged to contribute their unique talents and experiences and be certain that their voices will be heard.

What’s in store for the future?

In the near future, payments are set to undergo a profound transformation, becoming seamlessly integrated into our daily lives. Whether for businesses or individuals, the act of making a payment will fade into the background, becoming an ambient part of our transactions.

Companies like Shieldpay, offering powerful APIs to major banks, law firms, technology platforms, and fintechs, play a pivotal role in this shift. By seamlessly plugging into existing infrastructures, we contribute to the vision of payments becoming virtually invisible. As we undergo a technology shift, developing versatile products that cater to various use cases within different markets while avoiding needing individual product silos is the goal.

----------------------------------------------------------------------

This article was first published in The Fintech Times, you can find it here: https://thefintechtimes.com/behind-the-idea-shieldpay/

COMMENTS